A Fund managed by Swiss Life Asset Managers UK Limited

A Fund managed by Swiss Life Asset Managers UK Limited

A Fund managed by Swiss Life Asset Managers UK Limited

While UK markets are set to grapple with heightened geo-political risk and rising inflation through 2022, the economic environment should provide plenty of opportunities for property investors. The decline of the pandemic should translate into greater tenant demand, as occupiers seek out new spaces to work and live. Meanwhile, positive property returns are historically correlated with periods of robust economic growth.

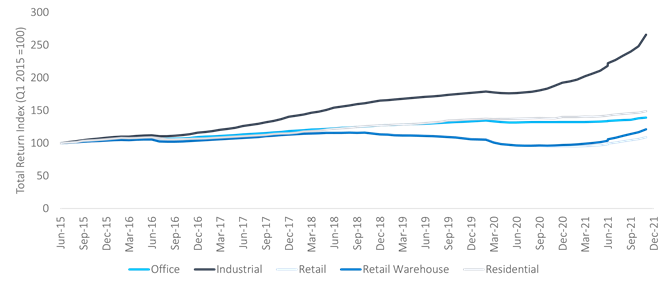

However, pandemic-induced structural shifts have accentuated sector polarisation within the property market. For many years, real estate investing was divided into three main sectors – industrial (including logistics), offices and retail, with the rest falling under the label ‘alternatives’. The pandemic has accelerated sweeping structural changes in the way we live, work and play, which has fundamentally altered the profile of property portfolios. Now, Covid-19 winners and losers can be narrowed down to specific sub-sectors.

This means investors must be selective to take advantage of the powerful dynamics at play. Understanding the themes that are guiding occupational behaviour will allow investors to identify precise areas of the property market that demonstrate clear long-term growth potential. Going forward, it will also be important to construct diversified portfolios that are aligned to structural change and prioritise high-quality assets to mitigate ongoing uncertainty.

Sector specific

The rise of e-commerce has notably changed the retail landscape, which has seen logistics properties go from strength to strength, at the expense of traditional high street locations. Following a record year for take up, we expect warehousing and logistics to dominate again in 2022 and beyond. The warehouse market delivered 9% rental growth in the last 12 months, while our assets in the space generated 27% capital growth over the same period.

One sector that faces increasing scrutiny is the office space. Despite a challenging Covid-19, we believe the sector still has long-term growth potential, as companies realise the fundamental role offices play in promoting productivity, collaboration and culture. Already, 80% of our previously vacant offices are now either let or currently under offer, which has coincided with pandemic restrictions easing. However, it will be important to select assets that are aligned to the themes of the future, such as those that enable co-working, have strong sustainability and wellness credentials, and are well connected.

We are similarly attracted to the hotel sector, which should rebound as tourism and business travel gradually resumes to pre-pandemic levels. This alternative sector provides exposure to a different type of tenant – long leases to operational entities with short stays by underlying occupants – and represents an important diversifier within balanced portfolios.

Away from commercial property, we have been increasingly drawn to the UK residential space. This sector saw close to 100% rent collection during the pandemic and offers a different return profile to commercial property sectors. Residential rents have comfortably outstripped both RPI and CPI inflation over a 30-year period. Several compelling thematic factors also support growth in the residential space. There is a structural undersupply of high-quality, energy-efficient and affordable homes to rent in the UK, an issue exacerbated by the unfolding cost-of-living crisis. For this reason, we are launching a new residential strategy that targets low-income families, with rents set at no more than 35% of household salary.

Quality is king

Amid ongoing structural change, investors must prioritise high-quality assets that are aligned with occupational demand. Better building quality not only results in satisfied occupiers and lower vacancy rates, but it can also lead to lease extensions and help to justify further rent increases.

Undeniably, tenants are becoming more discerning on the quality of buildings they occupy. If construction increases to meet the rising demand for real estate, occupiers will have even more choice, and it will be important to hold the highest quality assets.

For instance, although the warehouse sector has record low vacancy rates, we are seeing increasing demand for well specified assets, particularly those that boast generous eaves heights, spacious yards with good docking facilities and that are well located for both multiple transport nodes and labour supply. The anticipated increase in future supply is likely to lead to a valuation correction for those weaker specified or poorly located assets.

The environmental impact of property is also increasingly in the spotlight, as the UK progresses its carbon neutral aspirations. As such, buildings with poor energy efficiency credentials face potential income and capital value declines, due to weaker tenant demand and heightened capital expenditure risk, as increasingly stringent legislation is introduced. Selecting high-quality properties with sound climate and environmental characteristics will help create resilient portfolios over the long term.

We recently acquired a modern, purpose-built hotel in Leeds that meets these conditions. Constructed in 2017, the property is an operationally net-zero carbon building and has an EPC rating of A, as well as solar panels and electric vehicle (EV) charging points. This asset is insulated from future capital expenditure risk and should prove attractive to occupiers, therefore providing a source of sustainable and growing income.

Active improvements

Along with selecting new high quality buildings, upgrading the quality of existing assets within a portfolio is crucial, especially given 80% of properties in the UK that will exist in 2050 have already been built¹.

We prioritise a lean portfolio to build strong relationships with our tenants and make targeted improvements to the assets they occupy. By capturing energy use data with our tenants’ permission, a key initiative towards achieving realistic net zero carbon emissions, we were able to enhance the Fund’s environmental credentials and improve our GRESB score by 15%².

Occupier collaboration also enables us to identify tenant preferences more accurately and capitalise on opportunities to add value to underlying assets. We recently finished renovating T2 Trinity Park, an office building adjacent to Birmingham Airport and the new HS2 Interchange Station. When we purchased the site in 2016, the property had an EPC rating of E. Following modifications and significant capital expenditure, which included installing EV charging points and improved bike and shower facilities, its rating was upgraded to B. The revamp helped generate increased tenant demand and resulted in a 10-year lease agreement with leading facilities management company, Mitie Plc.

These positive outcomes reinforce the importance of taking a proactive approach to portfolio and asset management. Continuing structural change and the growing pressure to achieve net zero means that tenant demand is only likely to become more discerning. This requires a constant re-evaluation of portfolios to ensure they can stay relevant for the modern occupier. The last few years has seen an ever-widening gap between winning and losing assets. Rather than a transitory trend this now looks set to become a permanent feature of the market and a key determinant of real estate fund management performance.

Simon Martindale - PITCH Fund Director

¹ UKGBC: Climate change - UKGBC - UK Green Building Council

² PITCH Global Real Estate Sustainability Benchmark (GRESB) Score 2021 - https://marketing.mayfaircapital.co.uk/e/940263/ies-benchmark-report-gresb-pdf/hm1v3/139300883?h=kzJhUAvYGfLhkWHZQW5W6E5fWupUdx7IUfCQUfo8Y4s